good pet health insurance that actually helps in tough moments

What makes coverage feel genuinely good

I look for policies that are transparent, consistent, and fast with claims. Not flashy. Just accurate, predictable support when a pet is hurting and the bill is rising. Most plans reimburse care from any licensed vet, which is useful, but the difference shows up in the details.

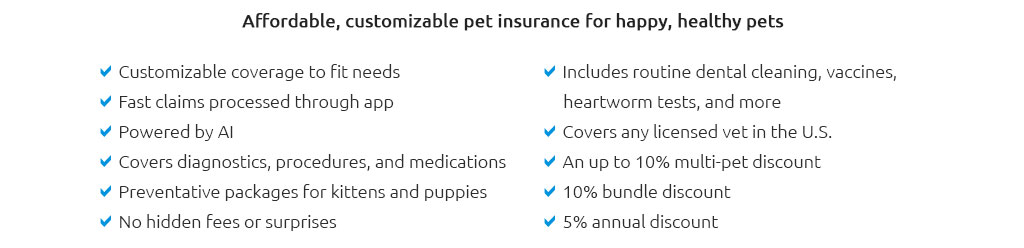

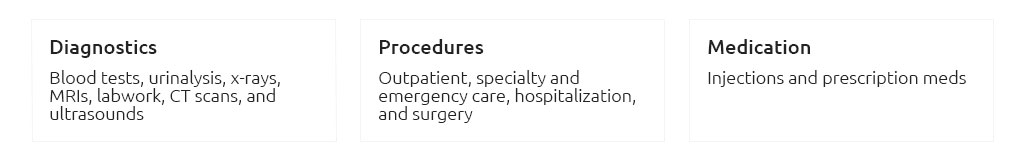

- Breadth of coverage: Accidents and illnesses are baseline; stronger plans include hereditary and chronic conditions, prescription meds, diagnostics, rehab, and sometimes behavioral therapy.

- Exam fees: Some cover them; others exclude. This small line item adds up over time.

- Dental care: Accident-only dental is common; illness-related dental (like periodontal disease) is rarer and valuable.

- Waiting periods and caps: Scan for orthopedic waiting rules, bilateral condition clauses, and any per-condition or lifetime caps.

- Claims accuracy: The explanation of benefits should match the policy wording, not a marketing summary. Accuracy beats hype.

I also value clear offers: multi-pet discounts, introductory accident coverage, or waived waiting periods for transfers from another insurer. Offers are nice; they should never distract from the policy's math.

The cost mechanics, without fog

Price moves with species, breed, age, and ZIP code. You'll choose a deductible (annual or per-incident), a reimbursement percentage, and an annual limit. Higher reimbursement and lower deductibles raise premiums; so do low limits on out-of-pocket risk. Simple cause, effect, cost.

- Get at least three quotes using the same pet details.

- Normalize settings: identical deductible, coinsurance, and annual limit so you can compare like to like.

- Read the sample policy, not just the brochure. Search terms: "pre-existing," "bilateral," "congenital," "waiting period."

- Check whether exam fees, prescription food, and therapeutic supplements are covered or excluded.

- Ask if they use a fee schedule or "usual and customary" cap; reimbursement should be based on your actual invoice when possible.

- Note claim turnaround times and methods (ACH, paper check) and whether weekend processing exists.

I used to think unlimited coverage always wins. Then again, a well-chosen $10,000 annual limit with a reasonable deductible can be more cost-effective for many households, especially if you can self-fund smaller issues and insure the catastrophic ones.

A grounded moment from real life

Saturday, 8:30 p.m., my friend's lab mix swallowed a sock. ER surgery total: $3,200. He paid at discharge, uploaded the itemized invoice and vet notes, and the claim settled in four business days. After a $100 deductible and 20% copay, reimbursement was $2,560 by ACH. The estimate matched the EOB line by line. No drama. That's what good pet health insurance looks like in practice - quiet accuracy when you need it, not noise.

What to scrutinize before you enroll

- Definitions: How the policy defines pre-existing, curable vs. incurable conditions, and "new episode" matters.

- Bilateral clauses: A torn left cruciate may exclude the right later under one "condition." Read carefully.

- Orthopedic riders: Some require exams or orthopedic reports to shorten waiting periods for knees and hips.

- Cancer coverage: Look for full diagnostics, chemo, radiation; avoid per-condition lifetime caps if possible.

- Behavioral and rehab: Important for long recoveries; verify visit limits and per-visit caps.

- Direct pay: A few clinics can be paid directly, but reimbursement-after-you-pay is still the norm.

- Rate changes: Renewals often rise with age and claims trends; ask for multi-year rate history and methodology.

Common offers, and what they really mean

You might see 10% multi-pet discounts, waived accident waiting periods, or a wellness bundle. Nice, but I treat these as tiebreakers, not decision-drivers. A modest discount won't fix narrow coverage or slow claims. Offers are only as good as the policy under them.

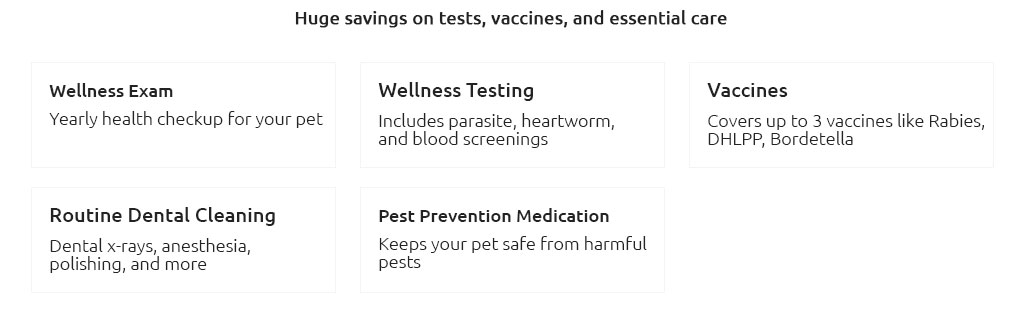

Wellness add-ons: convenience vs. value

Wellness plans (vaccines, exams, routine tests) are budgeting tools, not insurance. They often roughly break even across a year. If you prefer predictable cash flow and you'll use every included item, they're fine. If you're disciplined with savings, you may skip them and focus on robust illness/accident coverage.

The claim flow, step by step

- Pay the clinic and keep the detailed invoice (with CPT/procedure descriptions) and medical notes.

- Submit via app or portal; attach records and a short incident description.

- Watch for requests for prior history; fulfill quickly to avoid delays.

- Receive the EOB; confirm deductible, copay, and exclusions applied per policy wording.

- Reimbursement arrives via ACH or check; archive everything for renewals and future claims.

A fast accuracy checklist

- Request and read the sample policy before buying.

- Confirm the deductible is annual (usually simpler) or per-incident (can cost more over multiple events).

- Verify coverage of exam fees, dental illness, and chronic condition continuity at renewal.

- Note waiting periods for accidents, illnesses, and orthopedic conditions.

- Ask how "curable pre-existing" conditions are treated after a symptom-free window.

- Check claim turnaround averages and weekend processing.

- Record the reimbursement percentage, annual limit, and any sublimits in writing.

Bottom line

Good pet health insurance is measured by precise policy language, consistent reimbursements, and fair pricing over time. Clarity first, speed second, and marketing a distant third. If the numbers and wording line up, you'll feel protected - and that feeling holds up under the bright lights of the exam room.